Australia: navigating post-IPO escrow for key employees

These are exciting times for investors in Australian Initial Public Offerings (IPO) – especially key employees who hold Founder Shares. These employees often look to sell these shares as soon as the post-IPO escrow period ends. However, there is an alternative that enables them to raise funds while retaining exposure to their vested shares

– says Mitchell Hopwood at EquitiesFirst.

The last 12 months have been very difficult for humanity, but great for markets. After collapsing in the first quarter of 2020, global stocks have come roaring back faster and further than almost anyone expected. In April this year, the Dow Jones Industrial average crossed the 34,000 point mark for the first time.1 Here in Australia, the ASX200 breached 7,000 points for the first time since the pandemic began, coming within range of its all-time high.2

This extraordinary recovery in equities has been fuelled by unprecedented fiscal stimulus and monetary easing intended to cushion the impact of the worst economic crisis since the Second World War. In recent months, demand for stocks has been supercharged by growing optimism that the rollout of vaccines heralds a gradual return to pre-pandemic life around the world.

Bumper Crop of IPOs

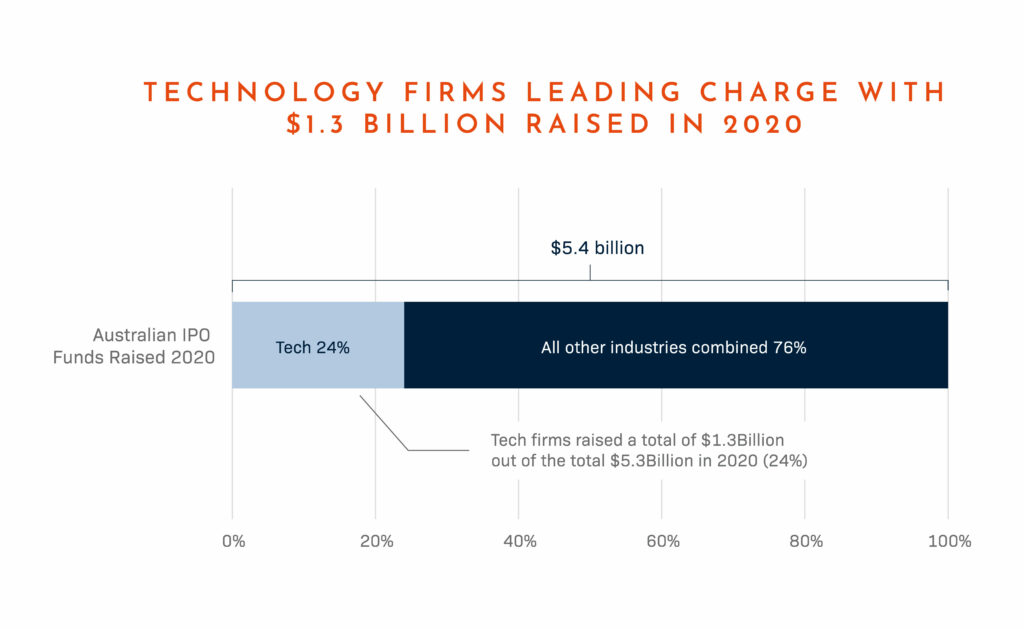

Not surprisingly, companies have been rushing to list in such buoyant markets, with analysts expecting another bumper year for Australia IPOs in 2021. It is also no surprise, given the shifts the pandemic has caused to how we work and live, that technology firms have been leading the charge. According to Bloomberg, they accounted for A$1.3 billion of the total A$5.4 billion raised through floats last year, achieving the sector’s biggest share of IPO volumes in at least 10 years.3

There were 66 IPOs in Australia’s 2020 vintage. Investors in these newly-listed companies have generally done well: they were up an average of 42% at the end of the year and markets have continued to rise since then.4 This performance has helped create wealth for employees who received share options ahead of those companies’ IPOs, among other shareholders. For employee shareholders of information technology stocks, the wealth effect has been even more pronounced: shares in this sector have returned more than 86% in the last 12 months.5

Employee Lock-Up

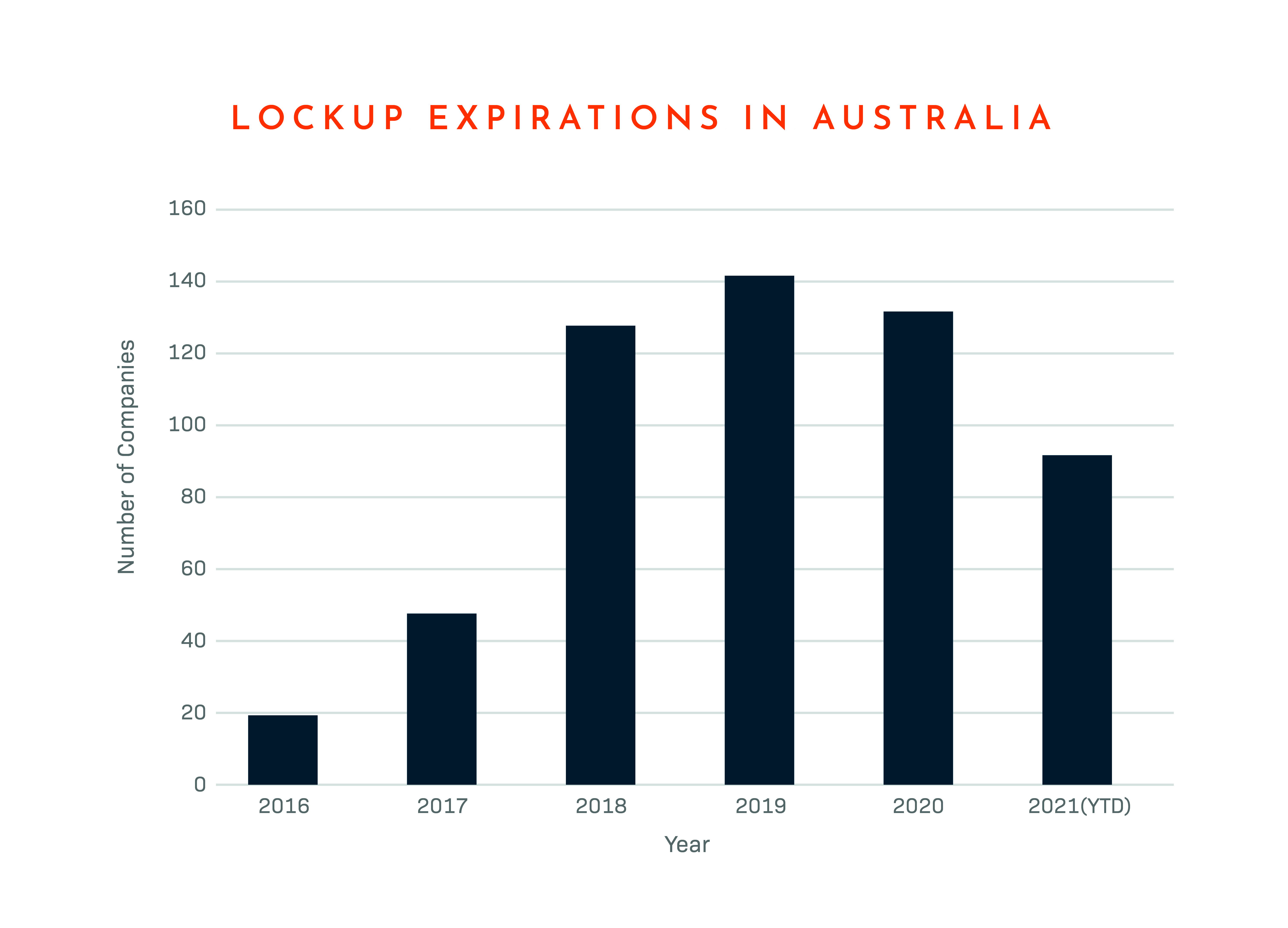

But these key investors – often senior management of the firm – are also typically subject to a “lock-up” provision that requires them to place their shares in an escrow account after the IPO.

For companies qualifying for an IPO through the ‘asset test’ – which requires them to have A$4 million of net tangible assets or a market capitalisation of A$15 million as well as A$1.5 million of working capital – the ASX will usually oblige certain shareholders to place their shares in escrow for a period of 12 to 24 months, depending on the type of shareholder and other circumstances.6

The provision applies to shareholders like seed investors, promoters and major shareholders, related parties like directors and professionals or consultants who have been paid for their services in shares. It aims to prevent these early investors from selling – and potentially causing volatility – before the market has had time to properly value the company through trading.7

Pre-IPO employee investors are often counting down the months, weeks and days until they are allowed to sell stock.

For many of these early investors, though, the escrow period is a frustrating but necessary delay between wealth being created for them through the IPO and them having access to that wealth. Pre-IPO employee investors are often counting down the months, weeks and days until they are allowed to sell stock.

That does not mean they lack confidence in their company: usually it just means they have immediate opportunities, expenses or other capital needs. They may also need to fund a tax payment: the Australian Taxation Office treats employee stock options as income once they vest, which makes them subject to a tax rate of as much as 45%.

Options for Equities Post Escrow

Investors in this situation sometimes assume that they have no alternative to selling their shares in order to meet their capital needs. Yet the private credit market does offer an attractive alternative: equity financing.

Through a non-recourse loan with EquitiesFirst, a shareholder can pledge a portion of their holding as collateral for their borrowing. The same number of shares will be returned to the borrower when the loan is repaid. During the life of the transaction, the original shareholder retains exposure to the performance of the shares and the right to receive dividend payments.

By accessing this alternative source of liquidity, a pre-IPO investor can retain their full shareholding when escrow ends, enjoy all the upside of owning the stock and make the investments, purchases or payments they had in mind.

免责声明

过去的业绩表现并不保证未来回报,个人回报将不受保证或担保。

本文件仅供认证投资者、成熟投资者、专业投资者或其他符合法律或其他方面要求的合格投资者使用,不适用于不符合相关要求的人士,也不应由其使用。本文件提供的内容仅供参考,是一般性的,并不针对任何具体的目标或财务需求。本文件中表达的观点和意见由第三方编写,未必反映EquitiesFirst的观点和意见。EquitiesFirst未独立审查或核实本文件提供的信息,且未声明其是准确或完整的。本文件中的意见和信息如有变更,恕不另行通知。所提供的内容不构成出售任何证券、投资或任何金融产品的要约或购买的要约招揽(“要约”)。任何该等要约只能通过列明其实质性条款和条件的相关要约或其他文件作出。本文件中的任何内容均不构成Equities First Holdings, LLC或其子公司(统称为“EquitiesFirst”,于中国內地市场则为“易峯”)购买或出售任何投资产品的建议、招揽、邀请、诱导、促销或要约。本文件也不应以任何方式解释为投资、法律或税务建议,也不应解释为EquitiesFirst的建议、参考或背书。在就财务产品作出投资决策前,您应寻求独立的财务意见。

本文件包含EquitiesFirst在美国和其他国家/地区的知识产权,包括但不限于各自的标志以及其他已注册和未注册的商标和服务标志。EquitiesFirst保留本文件中包含的对其知识产权的所有权利。接收方不得向任何其他人分发、出版、复制或以其他方式提供本文件的全部或部分内容,特别是不得向分发行为可能导致违反任何法律或监管要求的任何国家/地区的人士分发本文件。

EquitiesFirst不就本文件作出任何陈述或保证,并明确否认法律规定的任何默示保证。您承认EquitiesFirst在任何情况下均不对任何直接、间接、特殊、后果性、偶发性或惩罚性损害负责,包括但不限于利润损失或机会损失,即使EquitiesFirst已被告知此类损害的可能性。

EquitiesFirst做出以下可能适用于所述司法管辖区的进一步声明:

澳大利亚: Equities First Holdings (Australia) Pty Ltd(ACN:142 644 399)持有澳大利亚金融服务许可证(AFSL编号:387079)。保留所有权利。

本文件包含的信息仅适用于身处澳大利亚,且按《2001年公司法》第761G节的定义归类为批发客户的人士。向该标准以外的人士分发信息可能受到法律的限制,获得信息的人士应寻求咨询意见并遵守任何此种限制。

本文件包含的材料仅供参考,且不得解释为购买或销售金融产品的要约、招揽或建议。

本文件包含的信息属于一般性信息,并非个人财务产品建议。本文件中的任何建议仅为一般性建议,在编写时未考虑您的目标、财务状况或需要。在采纳任何信息之前,您需要根据您的目标、财务状况和需要考虑所提供的信息的适当性和相关财务产品的性质。在就财务产品做出投资决策之前,您应征求独立的财务建议并阅读相关披露声明或其他要约文件。

预测具有不确定性,不应过度依赖。 此信息仅反映Equities First Holdings (Australia) Pty Ltd在本资料发布时所持有的观点。

迪拜: Equities First Holdings Hong Kong Ltd(迪拜国际金融中心代表处)(地址为Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre,商业许可证编号为CL7354)作为一家代表处接受迪拜金融服务管理局(“DFSA”)监管(DFSA公司参考编号:F008752)。保留所有权利。

本文件包含的信息属于一般性信息,从被视为建议的角度而言,本文件中的任何建议仅为一般性建议,在编写时未考虑您的目标、财务状况或需要,也未考虑金融产品是否适合您。

本文件包含的材料仅仅是为了提供信息,不得被解释为财务建议,包括购买或销售金融产品的要约、招揽性信息或建议。本文件包含的信息属于一般性信息,本文件中的任何建议仅为一般性建议,在编写时未考虑您的目标、财务状况或需要,也未考虑金融产品是否适合您。在采纳任何信息之前,您需要根据您的目标、财务状况和需要考虑所提供的信息的适当性和相关金融产品的性质。如果您不理解本文件的内容,您应咨询获授权的财务顾问。

本文件与某一金融产品有关,该金融产品不受DFSA任何形式的监管,也无需获得DFSA任何形式的批准。DFSA不负责审查或核实与本金融产品有关的任何文件。因此,DFSA未批准本文件或任何其他相关的文件,也未采取任何举措来核实本文件所载的信息,并且对其概不负责。

中国香港: Equities First Holdings Hong Kong Limited根据《放债人条例》持有牌照(放债人许可证编号1659/2024),并根据《证券与期货条例》(“SFO”)(CE编号:BFJ407)从事证券交易业务(第一类牌照)。本文件未经香港证券及期货事务监察委员会审查。本文件不作为出售证券的要约或购买任何由Equities First Holdings Hong Kong Limited管理或提供的产品的招揽。本文件仅供SFO规定之专业投资者参考。本文件不针对此类要约或邀请将构成违法或禁止行为的个人或组织。

韩国: 上述内容仅适用于充分具备证券融资交易知识和经验的资深投资者、专业投资者或其他合格投资者。不适用于也不应由不符合标准的人士使用。

英国: Equities First (London) Limited在英国获得金融行为监管局(FCA)的授权,并接受其监管。在英国,本文件仅分发并提供给《2000年金融服务与市场法》(金融促进)2005年法令(FPO)中第四部分第19 (5)条(投资专业人士)和第49 (2)条(高净值公司、非法人团体等)所述的相关人士。与本文所述相关联的任何投资活动仅适用于且仅与该类人士有关。不具备投资事宜专业经验或非FPO第49条适用人士,不得依赖本文件。本文件仅适用于符合《金融工具市场指令》规定的专业投资者。