As traditional lenders retreat, securities backed financing marches on

The US Federal Reserve has now brought interest rates to their highest level in 22 years following its latest hike on July 26 – and it has not ruled out further increases.[1]

Acknowledging that the impact of tighter credit conditions on businesses and consumers remains uncertain, Federal Reserve Chairman Jerome Powell called on would-be borrowers to consider carefully whether now is the appropriate time to secure loans for investment and growth.[2] The trouble is, even if the answer is yes, they might not be able to obtain them from traditional sources.

Fortunately, companies struggling to raise funding from public bond and loan markets are finding they can turn to private financing. These companies report that, in contrast to traditional lenders’ reluctance or perhaps inability to provide funding, private financing providers are willing and appear to have “significant liquidity” to meet their needs.[3]

Indeed, current circumstances have provided private financing an opportunity to shine.

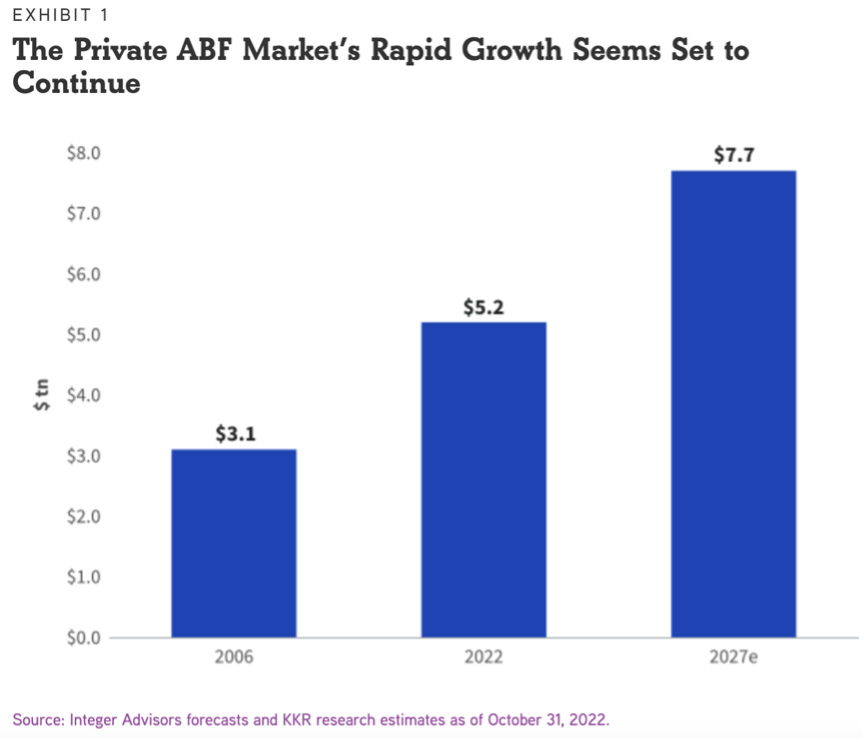

One category that looks set to accelerate after having ramped up steadily in the wake of the 2008 Global Financial Crisis is private asset-based finance (ABF).[4] From an estimated $3.1 trillion in 2006, the market grew to $5.2 trillion by 2022. And according to projections from leading global alternative investment managers KKR, it could expand further to 7.7 trillion by 2027, spurred on by the retreat of traditional lenders in response to rising interest rates and volatility in the banking system.[5]

Private ABF is an attractive proposition for long-term shareholders and other investors, particularly at a time of heightened economic and geopolitical uncertainty. It provides a potential inflation hedge, downside protection and access to lenders who are less exposed to short-term market movements.

EquitiesFirst’s progressive brand of asset-based finance – securities-backed financing – allows investors to use their equities or crypto to unlock capital for other needs while still maintaining upside participation in those holdings.

These investors can use the funds for a variety of business or personal purposes. Additional benefits include greater stability should central bank tightening persist and economic growth stall, as well as more diversified returns.

Moreover, with securities-backed financing, interests are aligned during the term of the loan as the investor’s equity is transferred to become a part of the EquitiesFirst portfolio and EquitiesFirst also becomes an investor in the stock alongside the owner.

As a dedicated securities-backed lender, we have worked tirelessly over the years to streamline and enhance our processes in a way that benefits the parties on both sides of each transaction. As such, we are able to offer a level of efficiency that other capital providers – such as banks and other large financial institutions, for whom asset-based finance is merely a niche product – are simply not in a position to provide.

Managing risks

We are also cautious about how we manage our own risks – putting us in a favourable position during these challenging times.

Ratings agency Moody’s has cautioned that the private credit industry is about to face its “first serious challenge”[6] as tens of billions worth of loans extended at the market’s peak in 2021 – when interest rates were still close to zero – are strained by economic headwinds and uncertainty along with the lack of guidance on just how long higher-for-longer interest rates will persist. Moody’s also singled out two of the largest companies in the sector – Ares and Owl Rock – as being at risk from rising defaults.

As of July, corporate defaults are already running at their fastest pace in more than a decade for companies with public debt.[7] Though these have not yet made a significant dent on the overall economy, analysts have warned that the strain of rising defaults is mounting, creating a worrying — if still modest — risk of a financial crisis.

This highlights the fact that not all private financing is the same. In times like these, securities-based financing shows its worth. Though facilities need to be structured carefully, in general risks are limited by the capital provider’s ability to recover the securities or crypto provided by the investor to back the financing – and structured as a sale and repurchase agreement. This is also conducive to preserving systemic financial stability.

Structuring deals in this way has helped EquitiesFirst grow sustainably for 20 years – meeting investors’ needs in both buoyant and rocky markets.

[1] https://www.ft.com/content/110bd237-cbf2-463d-b1b5-edcb98245851

[2] https://www.forbes.com/sites/rohitarora/2023/07/26/fed-raises-interest-rates-to-22-year-high-credit-crunch-continues-for-small-businesses/?sh=4b3afef75b21

[3] https://www.reuters.com/business/finance/asias-private-credit-markets-thrive-desperate-borrowers-find-lenders-2023-07-20/

[4] https://www.kkr.com/global-perspectives/publications/asset-based-finance-fast-growing-frontier-private-credit

[5] https://www.kkr.com/global-perspectives/publications/asset-based-finance-fast-growing-frontier-private-credit

[6] https://www-ft-com.ezp.lib.cam.ac.uk/content/de6eb245-80ff-4f9c-b2ed-7a415538512b

[7] https://www.nytimes.com/2023/07/26/business/credit-markets-uncertainty-interest-rates.html

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.