Australian entrepreneurs look past critical minerals downturn

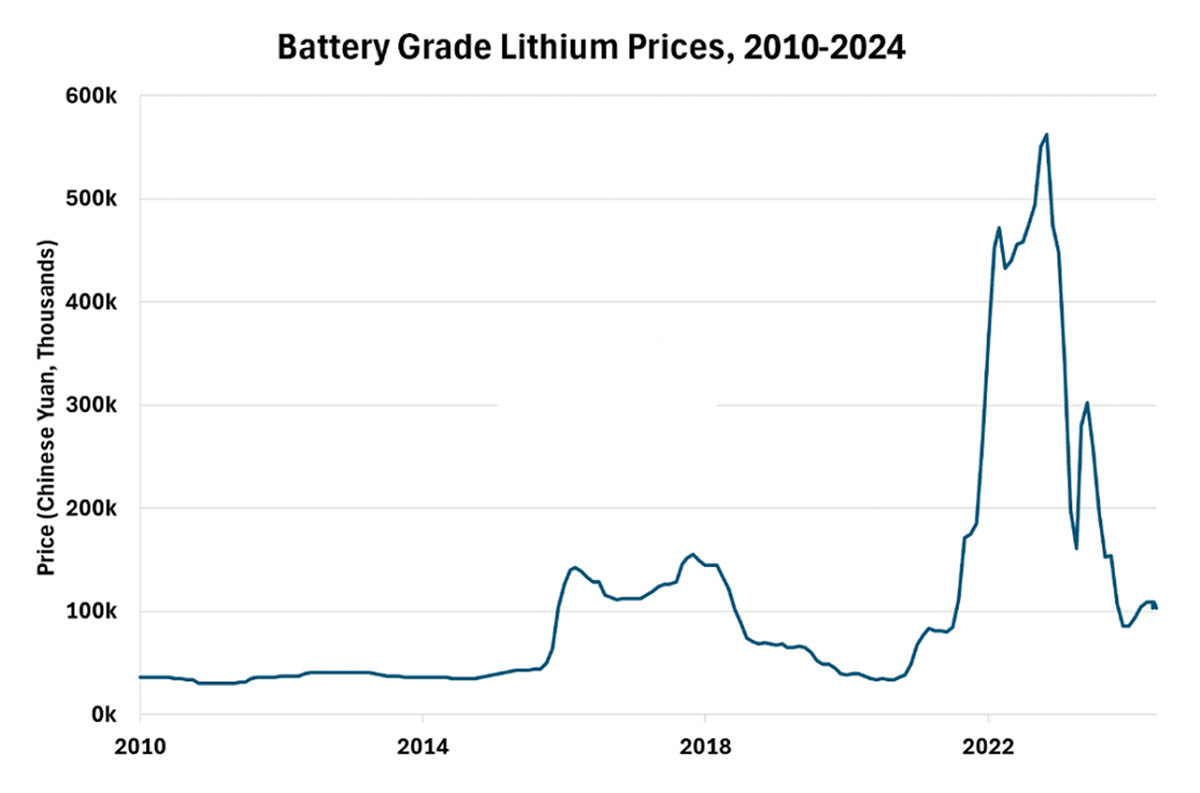

In November 2022, the price of battery-grade lithium carbonate in China — the world’s largest lithium market — briefly touched USD81,000 per tonne before it came crashing back to earth.[1]

Figure 1:

Image source: https://carboncredits.com/understanding-lithium-prices-past-present-and-future/

During those heady days, in 2022, Tesla CEO Elon Musk posted a characteristically feverish tweet: “Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.”[2]

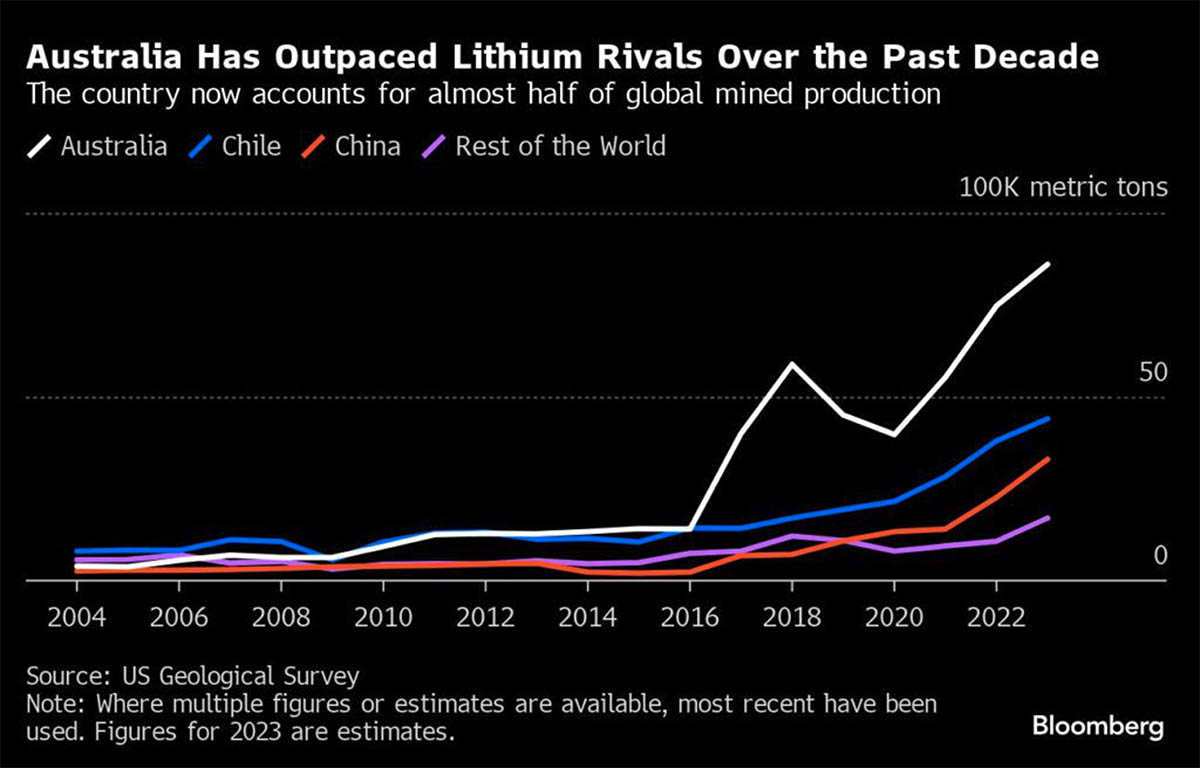

Musk can shelve those diversification plans, with the price back to around USD14,500 per tonne at the end of May 2024.[3] But the repricing has been unwelcome for the resources sector in Australia, the world’s largest producer (see Figure 2) of the metal, which is used in rechargeable batteries for EVs, mobile phones, laptops, digital cameras.

Figure 2:

Taking it in stride

Commodities are known for their wild boom and bust cycles, however, and Australia’s forward-thinking miners remain upbeat about lithium’s prospects given the expected long-term demand for lithium and other critical minerals essential to driving the energy transition.

Pilbara Minerals chief executive Dale Henderson, for example, anticipates a “fairly material” uptick in prices.[4] Heavyweights such as Hancock Prospecting[5] and Mineral Resources[6] have been snapping up lithium assets. And BHP and Rio Tinto have warned that the supply of metals like lithium, nickel, copper, rare earths and aluminum could struggle to keep up with the demands of global decarbonization efforts.[7]

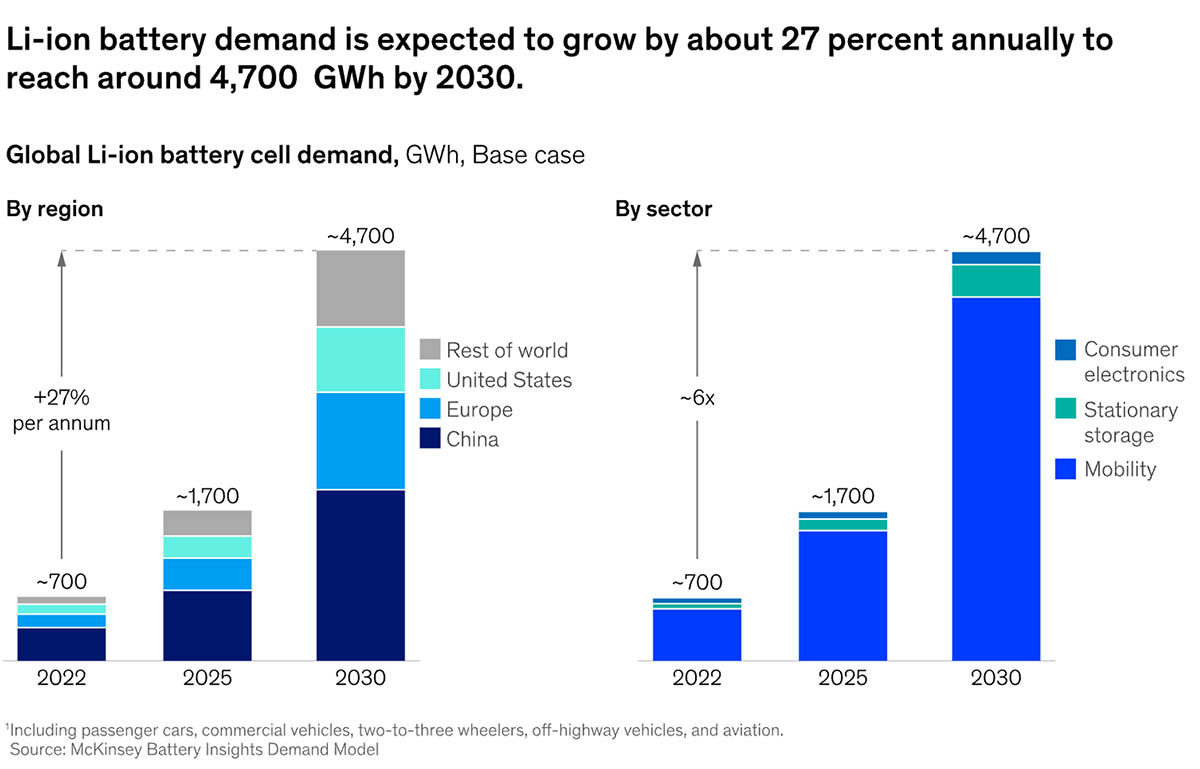

That optimism about lithium, and especially for lithium-ion batteries, goes beyond the mining sector. Consultancy McKinsey foresees a steep and steady increase in demand up to 2030 (see Figure 3).

Figure 3:

Image source: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/battery-2030-resilient-sustainable-and-circular

In response, Pilbara dug into its cash reserves in Q1 2024 to fund new spending on mine and processing projects in Western Australia.[8] It is also ramping up its processing plant in South Korea. Such investments will be key to countering China’s near-monopoly in processing lithium-rich spodumene into the refined materials needed to meet growing demand for batteries.[9]

Meanwhile, though Bank of America’s Head of Metals Research, Michael Widmer, issued a bearish forecast for lithium prices, he revealed in a recent note to clients that “Western producers keep pushing ahead on expectations that lithium demand will expand thanks to policies.”[10]

The Australian Government’s recently introduced Critical Minerals Production Tax Incentives commits A$7 billion over the coming decade to bolster the processing of critical minerals.[11] In the US, the Inflation Reduction Act provides sizeable incentives to expand manufacturing of EVs in America.[12] Policies like these could bolster lithium’s outlook over the next few years. There have also been calls for the Australian government to step in and support the lithium sector by establishing a strategic reserve.[13]

Calling the bottom

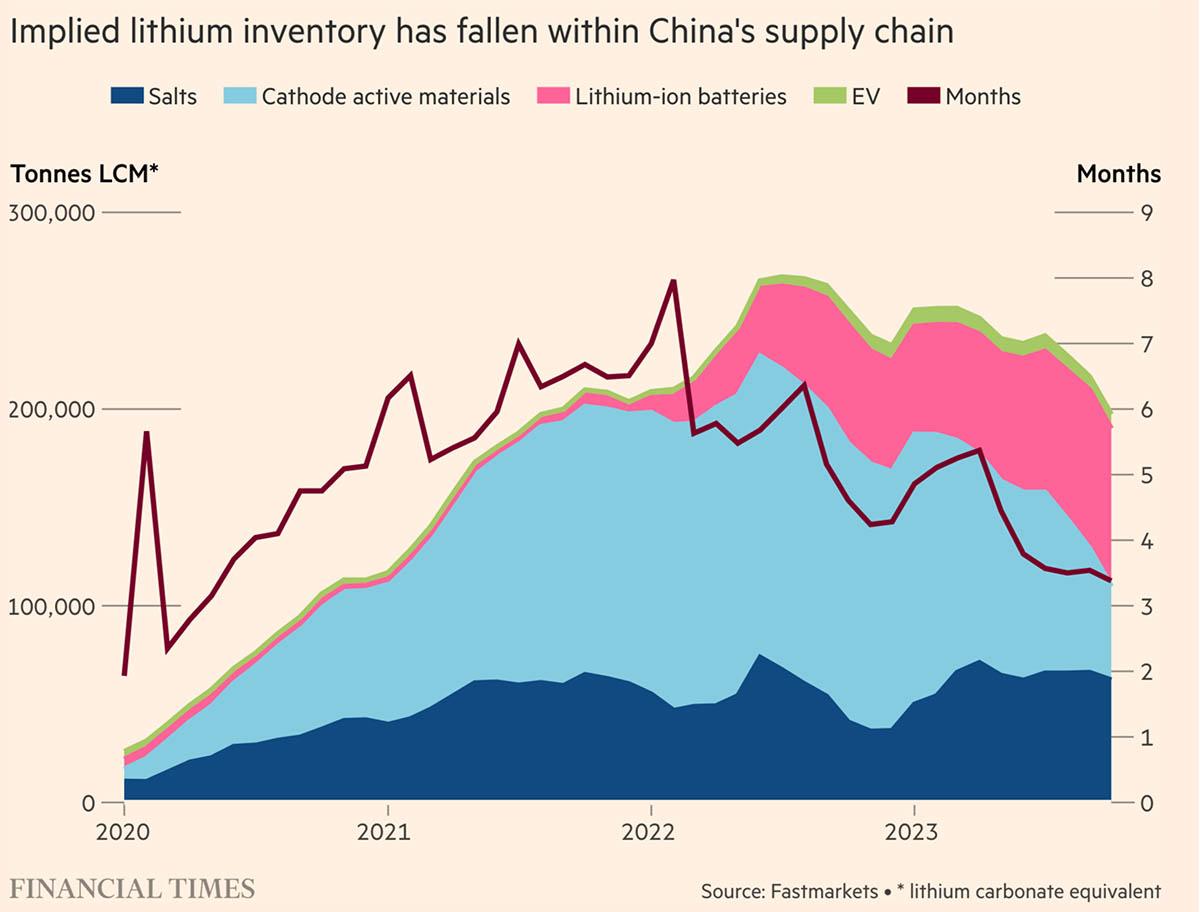

There is a growing sense that financial analysts have got it wrong on lithium, and that rather than facing chronic oversupply, the market could soon even be undersupplied.[14] There are already signs that inventories are thinning (see Figure 4). Moreover, a significant acceleration of investment in green technologies could lead to swift and sustained support for prices.

Figure 4:

Image source: https://www.ft.com/content/0fb27a1a-d149-4d66-87cf-a1e3feecb5e5

For some, the biggest lesson from recent price swings is that the industry needs a more stable supply of lithium to ensure its healthy development.[15] Therefore, while a few miners have sought to cut costs and scale back expansion plans, those who never lost faith in the metal are seeking liquidity to fund continued investment in capacity both upstream and downstream.

Funding those investments, however, has become more difficult.

Australia’s big four banks have slashed their exposure to the domestic resources sector to a decade low because of diminished risk appetite and an erosion of in-house talent equipped to cater to the needs of the mining industry.[16] Take Commonwealth Bank, where total committed exposure to resources has slumped from almost A$17 billion to A$7 billion between 2015 and 2022.[17]

Turning to alternative financing

This has led Australia’s critical minerals producers to turn to alternative sources of financing, including end consumers, shareholder equity, government funding and export credit agencies.[18] At EquitiesFirst, we have also seen strong demand for liquidity from our own Australian clients, including from long-term shareholders in the resources sector.

Australia’s miners are not alone in pursuing additional capacity. China’s top lithium firms, too, are confident about long-term prospects, looking past their near-term profit slump to pursue expansion.[19] Indian companies are in search of lithium investments around the world, including in Australia.[20] And, of course, Chilean lithium giant SQM is undertaking an aggressive expansion in Australia.[21]

At a time when traditional lenders are wary about Australia’s resources sector, entrepreneurs with an eye on the longer game remain confident. Specialty financing, including equities-backed financing, could play a role in supporting the sector’s development and helping to maintain a steady supply of the critical minerals needed to keep the world on track to net zero.

[1] https://carboncredits.com/why-lithium-prices-are-plunging-and-what-to-expect/#:~:text=The%20Steep%20Decline%20in%20Lithium%20Prices&text=Lithium%20carbonate%20prices%20have%20experienced,decrease%20year%2Don%2Dyear.

[2] https://www.bloomberg.com/news/articles/2022-04-08/tesla-may-start-mining-lithium-as-musk-cites-battery-metal-cost

[3] https://www.fastmarkets.com/insights/china-lithium-spot-prices-inch-down/

[4] https://www.afr.com/companies/mining/pilbara-minerals-calls-fairly-material-uptick-in-lithium-prices-20240419-p5fl2f

[5] https://www.australianmining.com.au/will-rinehart-drum-up-another-lithium-frenzy/

[6] https://www.australianmining.com.au/minres-strikes-hot-on-lithium

[7] https://www.afr.com/companies/mining/bank-exposure-to-resources-sector-crashes-to-decade-low-20230316-p5csvi

[8] https://www.afr.com/companies/mining/pilbara-minerals-calls-fairly-material-uptick-in-lithium-prices-20240419-p5fl2f

[9] https://www.bloomberg.com/news/articles/2024-04-25/ev-batteries-miners-are-betting-lithium-could-be-a-green-lifeline-for-australia

[10] https://www.afr.com/markets/commodities/bank-of-america-slashes-lithium-price-forecasts-for-2024-2025-20240201-p5f1i8

[11] https://www.mining-technology.com/news/australia-tax-critical-minerals/#:~:text=Australia%20commits%20A%247bn%20to%20tax%20incentive%20for%20critical,cobalt%2C%20nickel%20and%20rare%20earths.

[12] https://chicagopolicyreview.org/2023/01/26/the-inflation-reduction-acts-big-bet-on-electric-vehicles/

[13] https://www.afr.com/companies/mining/australia-can-save-the-global-lithium-industry-from-the-chinese-state-20240205-p5f2dc

[14] https://www.afr.com/markets/commodities/this-fund-is-betting-wall-street-banks-have-lithium-slump-call-wrong-20240404-p5fhfz

[15] https://news.bloomberglaw.com/private-equity/the-lithium-world-confronts-hard-truths-after-epic-boom-and-bust

[16] https://www.afr.com/companies/mining/bank-exposure-to-resources-sector-crashes-to-decade-low-20230316-p5csvi#:~:text=The%20big%20four%20banks’%20exposure,in%20%E2%80%9Cfuture%20facing%E2%80%9D%20commodities.

[17] https://www.afr.com/companies/mining/bank-exposure-to-resources-sector-crashes-to-decade-low-20230316-p5csvi#:~:text=The%20big%20four%20banks’%20exposure,in%20%E2%80%9Cfuture%20facing%E2%80%9D%20commodities.

[18] https://www.afr.com/companies/mining/bank-exposure-to-resources-sector-crashes-to-decade-low-20230316-p5csvi#:~:text=The%20big%20four%20banks’%20exposure,in%20%E2%80%9Cfuture%20facing%E2%80%9D%20commodities.

[19] https://www.bloomberg.com/news/articles/2024-04-01/top-china-lithium-firms-look-past-profit-slump-and-vow-expansion

[20] https://www.business-standard.com/companies/news/khanij-bidesh-india-likely-to-acquire-lithium-asset-in-australia-in-fy25-124051100323_1.html

[21] https://www.afr.com/companies/mining/chilean-lithium-giant-flags-aggressive-australian-expansion-20240307-p5fajw

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Equities First Holdings (Australia) Pty Ltd as at the publishing date of this material.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.