Using specialty financing to tap into the UK’s data center boom

15 October 2024

When you think of investment opportunities stemming from the emergence of new technologies like generative AI – along with the proliferation of cloud computing, big data analytics and connected devices – real estate is probably not what immediately comes to mind. But given that the advance of technology will drive a massive increase in demand for data storage and processing, Moody’s projects a doubling in global data center capacity over the next five years.[1] This will require more land to not only build the data centers themselves, but also the infrastructure needed to support the power-hungry facilities.

The coming boom in data center capacity will be concentrated in certain countries and regions. The UK, and Greater London specifically, are likely to be among them.

The UK hosts the largest number of data centers in Western Europe, generating an estimated £4.6 billion in annual revenue,[2] and is a key hub for connectivity worldwide. Moreover, with data center permits in Dublin and Germany currently on hold owing to concerns over high power consumption,[3] industrial and urban warehousing property developers have been capitalizing on the opportunity to widen the UK’s lead as the region’s No. 1 data center hub.

Unlike governments elsewhere in Europe, the new Labour government has pledged to make it easier to build data centres in the UK.[4] In September, it designated the country’s data centers as ‘Critical National Infrastructure’. This marks the first Critical National Infrastructure (CNI) designation since the Space and Defense sectors gained the same status in 2015, and should help overcome objections by local councils that might otherwise stall data center projects across the country.

And so, in contrast to the slump in the overall property market over the past three years, data center real estate deals have been booming in the UK.[5]

Microsoft,[6] Amazon[7] and Google[8] are building several large-scale data centers across the UK involving billions of dollars of investment.

Power bottleneck

The biggest issue now is availability of power. Considering that an average ChatGPT query needs nearly 10 times as much electricity to process as a Google search,[9] our data-related power demands are set to explode.

Morgan Stanley analysts estimate that data centers will account for 4% of power demand by 2035, up from 1% today.[10] In the UK, National Grid Chief Executive John Pettigrew recently said that power use by data centers would increase six-fold in the next decade,[11] warning that the grid was becoming “constrained” and that “bold action” was needed to create a network able to cope with “dramatically” growing demand.

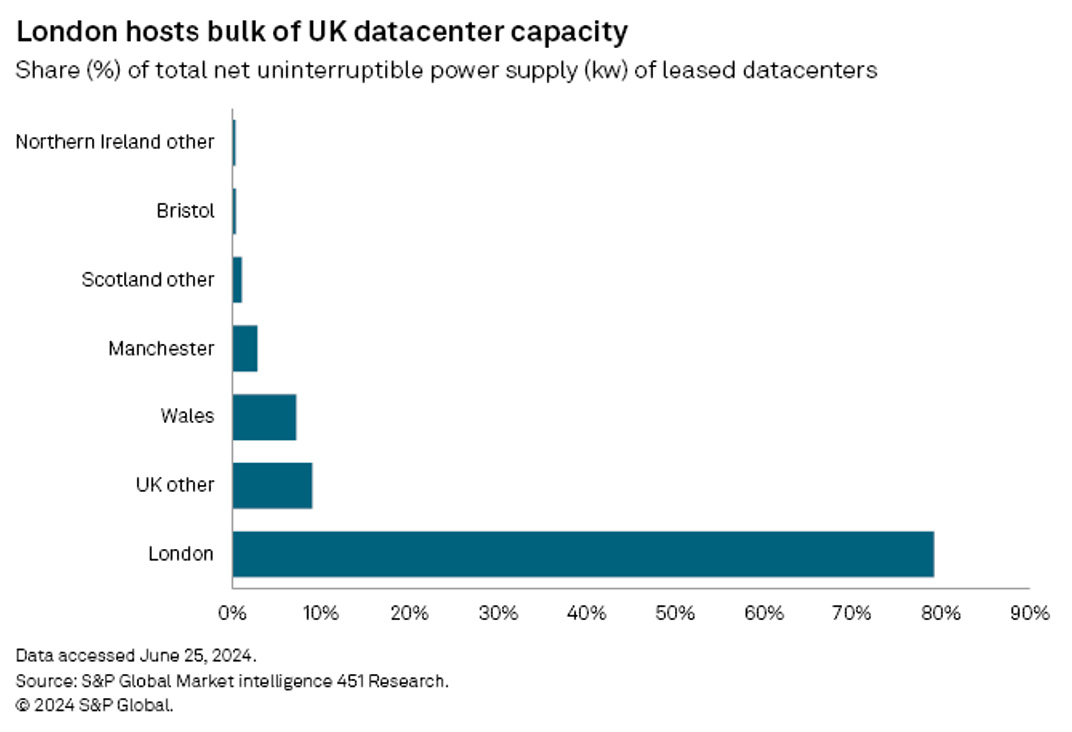

This issue is compounded by the fact that nearly 80% of the UK’s data center capacity is concentrated in or near London, with clusters in Slough, the City and the Docklands (see Figure 1). This is because data center operators typically look for sites near their biggest customers to reduce latency, or the amount of time it takes for data to move from one point to another.

Figure 1: Most of the UK’s data center capacity is in London

Source: S&P Global Market Intelligence 451 Research

After all, although London is perhaps best known as a global financial center, it is also one of the most technologically advanced communities in Europe in terms of adoption of cloud and new technologies, and also a hub for software, internet of things (IoT) and AI development.

So, while the North of England and Scotland are well-positioned to host sustainable large-scale data centers, with access to renewable energy sources and cooler climates that reduce the need for energy-intensive cooling systems, data center developers will continue wanting to locate facilities in the South of the country because that’s where the users are. Furthermore, growing demand for smart devices that rely on edge computing could increasingly drive demand for smaller edge data centers in or near urban centers.

This could translate into a windfall for landlords in space-constrained London, who will have opportunities not only to sell or lease land to big companies – such as cloud vendors, banks or telcos – to own and operate their own data centers, but also from the spread of co-location facilities. A co-location center is essentially a data center that rents out space to third parties to host their own servers and usually provides access to network capacity and power, as well as cooling equipment.

Data centers, and co-location facilities especially, have attracted the interest of investors in recent years because of their steady, utility-like cash flows and high risk-adjusted yields.[12] Private equity investors have accounted for a major share of those deals.

Other data center-driven opportunities

In addition to real estate, the UK’s growing data center economy is likely to drive demand in four adjacent areas: sustainable energy; cooling systems; construction services; and computing equipment.[13] In particular, cutting-edge climate technologies could help overcome the power bottleneck.

Developing data centers is a capital-intensive undertaking which requires large up-front investment. According to Moody’s, “the ability to secure funding will be a critical determinant of how quickly and efficiently these data centers can scale.”[14]

Financing from a variety of sources is therefore needed to capitalize on the explosion in demand for data centers, with sources of alternative capital needed to supplement traditional bank lending. Because even though interest rates could be on the way to falling further, banks remain wary of taking on more risk in the current environment.

For investors looking to capitalize on data center-related opportunities, securities-based financing can be a compelling alternative in the current climate, providing a flexible, cost-effective and stable form of capital with no restrictions on the use of funds. Whether investing in private equity vehicles, real estate assets or associated industries, financing from EquitiesFirst allows investors to monetize their long-term shareholdings and unlock the flexible capital they need to take a view on the sector.

[1] https://www.moodys.com/web/en/us/creditview/blog/data-centers-rapid-growth-brings-long-term-risks.html

[2] https://thelens.slaughterandmay.com/post/102jj5n/designating-uk-data-centres-as-critical-national-infrastructurea-new-era-of-gro#:~:text=The%20UK%20hosts%20the%20largest,key%20hub%20for%20connectivity%20worldwide.

[3] https://www.datacenterdynamics.com/en/opinions/data-center-capacity-demand-for-ai-cloud-and-digital-services-pioneers-uk-real-estate-market/

[4] https://www.datacenterknowledge.com/regulations/what-the-new-uk-government-means-for-the-country-s-data-center-sector

[5] https://www.datacenterdynamics.com/en/opinions/data-center-capacity-demand-for-ai-cloud-and-digital-services-pioneers-uk-real-estate-market/

[6] https://sg.news.yahoo.com/microsoft-eyeing-many-more-uk-151439794.html

[7] https://www.wsj.com/tech/ai/amazon-to-invest-10-5-billion-in-u-k-for-cloud-ai-infrastructure-62220fe7

[8] https://www.bloomberg.com/news/articles/2024-01-18/google-to-invest-1-billion-in-new-uk-data-center-to-meet-demand

[9] https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

[10] https://www.reuters.com/breakingviews/data-centre-boom-reveals-ai-hypes-physical-limits-2024-07-04/

[11] https://www.bbc.com/news/technology-68664182

[12] https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/investing-in-the-rising-data-center-economy

[13] https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/investing-in-the-rising-data-center-economy

[14] https://www.moodys.com/web/en/us/creditview/blog/data-centers-rapid-growth-brings-long-term-risks.html

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.