Alternative capital can help entrepreneurs keep hold of high-end Hong Kong properties

26 September 2024

Hong Kong’s ultra-luxury residential property market has been dominated by distressed sales in 2024, highlighting the difficulty some of the city’s leading entrepreneurs have faced in raising capital over the past year. In July, for example, a relatively low-profile business family sold Houses A to D at 26 Plantation Road for HK$1.1 billion (US$141 million), representing a 35% discount to market prices, to repay a HK$1.6 billion private loan secured against the property.[1] The buyer was described by the broker who arranged the sale as “a local with financial strength.”

In another notable fire sale, an ultra-luxury mansion held by a company linked to a top executive of bankrupt China property giant Evergrande Group was seized by receivers and disposed of in May for HK$450 million, more than 40% below its valuation in 2023.[2]

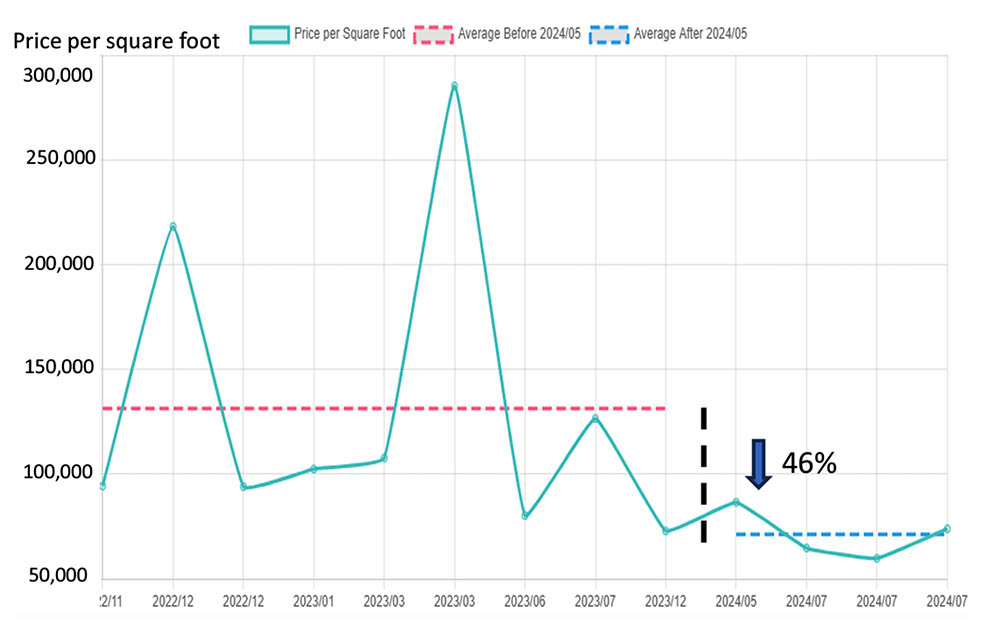

These are just two of several properties snapped up by opportunistic buyers in Hong Kong’s most exclusive neighborhood, The Peak, in the three months ending July 2024 at prices averaging 46% below their Covid-era valuations, according to international property agency Savills.[3] The agency attributed the sharp decline in prices largely to “several instances of distressed sales, where property owners were compelled to sell to settle outstanding debts.”

Figure 1: Significant luxury transactions by average prices, November 2022 to July 2024

Savills added that it expected more financially pressured owners to look to offload “some of their most valuable assets that are rarely on the open market” – an opportunity that it expected would attract plenty of interest from cash-rich buyers.

Selling at the bottom?

Sellers may soon come to regret offloading their properties in distressed deals following the US Federal Reserve’s decision to start cutting interest rates in September. This will not only make their loan repayments more manageable, but also paves the way for Hong Kong mortgage rates to come down.

Hong Kong’s property market has already experienced a bounce after the government scrapped its decade-old property market curbs from April, including removing all extra stamp duties and easing mortgage restrictions.[4] This led to total property sales in the city reaching a ten year-high in April. With interest rates finally coming down, the initial uptick that followed could now turn into a sustained recovery.

High borrowing costs have arguably been the single biggest factor weighing on Hong Kong’s home prices over the past two years. Lower interest rates could bring buyers who have been waiting on the sidelines back to the city’s high-end property market. After all, the fundamentals behind Hong Kong’s sky-high luxury property prices remain firmly in place, including the city’s role in connecting China to the world, its status as a leading global financial center, and its very limited land supply, especially in areas like The Peak.

Another positive sign is that Hong Kong’s rental markets have remained relatively stable, supported by an ongoing influx of professionals that has been helped by government schemes to attract talent from abroad.[5] Property agent Knight Frank predicts this could drive an increase in luxury residential rents of up to 5% this year.

Several analysts, including those at Goldman Sachs, expect Hong Kong home prices to bottom out this year, before reversing direction.[6]

In line with the shifting prospects of the city’s beleaguered property market, the beaten-down stocks of Hong Kong-listed developers may also be worth looking at.

Meanwhile, in Mainland China, the latest sales data shows wealthy buyers have been snatching up luxury homes in Tier-1 cities such as Shanghai, Beijing, Guangzhou and Shenzhen in August following several rounds of easing of property rules this year.[7] Unlike Hong Kong, however, China’s luxury property market is expected to see significant new supply in the second half of 2024, which could cut short the nascent recovery.[8]

Avoiding distressed sales

The recent forced sales in Hong Kong’s ultra-luxury property market underline the risks facing investors who pledge real assets as security for loans. In some cases, access to alternative capital, such as equity-backed financing, can help these investors avoid fire sales by monetizing their long-term shareholdings instead. And in the case of EquitiesFirst’s financing model, borrowers can retain the upside if those shares go on to increase in value.

Access to flexible and convenient financing could prove especially valuable at this juncture, allowing entrepreneurs to raise capital without having to sell luxury properties at prices well below their peak of July 2018.[9]

Long-term shareholders in Hong Kong-listed property developers may also wish to either raise capital to increase their positions ahead of the market reversal or diversify their positions through investments in other sectors, especially as the Hong Kong government looks at more steps to boost the local bourse.[10]

[1] https://www.scmp.com/business/article/3269972/hong-kongs-ho-shun-pun-family-sells-4-homes-peak-us141-million

[2] https://www.scmp.com/business/article/3263513/seized-hong-kong-peak-mansion-linked-china-evergrande-founder-hui-ka-yan-sells-40-discount-us58

[3] https://pdf.savills.asia/asia-pacific-research/hong-kong-research/hong-kong-residential/market-in-minutes-residential-sales-aug-2024-e—final.pdf

[4] https://www.scmp.com/special-reports/article/3271668/how-hong-kong-property-market-bouncing-back-2024-especially-luxury-sector?module=perpetual_scroll_0&pgtype=article

[5] https://www.scmp.com/special-reports/article/3271668/how-hong-kong-property-market-bouncing-back-2024-especially-luxury-sector?module=perpetual_scroll_0&pgtype=article

[6] https://www.scmp.com/business/companies/article/3251739/goldman-sachs-says-hong-kong-home-prices-will-rebound-2025-after-hitting-bottom-year-raises-office

[7] https://www.scmp.com/business/china-business/article/3277646/chinas-ultra-rich-are-snatching-luxury-homes-bet-first-tier-cities

[8] https://www.scmp.com/business/china-business/article/3277646/chinas-ultra-rich-are-snatching-luxury-homes-bet-first-tier-cities

[9] https://www.scmp.com/business/article/3252461/hong-kongs-luxury-homes-market-shows-signs-life-waves-price-discounts-entice-some-bottom-fishing

[10] https://www.reuters.com/markets/asia/hong-kong-leader-says-government-considering-more-steps-boost-stock-market-2024-04-08/

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Equities First Holdings (Australia) Pty Ltd as at the publishing date of this material.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.