Each of Asia’s leading family office hubs are gateways to economically important regions. Hong Kong connects the world to mainland China, and vice versa. Dubai is a major access point for the Middle East and Africa. But one of the fastest growing destinations for managing family wealth is Singapore, thanks to both favorable policies and its geographical position as a springboard to opportunities in the dynamic Association of Southeast Asian Nations (ASEAN) region. That’s luring firms from around Asia – and notably from South Korea – to setup shop in the Southeast Asian city-state.

By the end of 2023, 1,400 single-family offices (SFOs) had been established in Singapore,[1] many taking advantage of the Variable Capital Company (VCC) structure introduced there in 2020. Although it has robust requirements, the VCC structure offers several key advantages, including tax-exempt distributions of dividends to shareholders[2] and privacy protections – the register of members of a VCC does not need to be disclosed publicly.[3]

The VCC structure embraced by family offices is just one example of the pro-investment policy stance that has helped make tiny Singapore, spanning just over 700 sq. km and home to nearly 6 million people, one of the preferred destinations for millionaire migrants globally. It is forecast to receive the world’s third largest net inflow of high-net-worth individuals in 2024, following closely behind the United Arab Emirates in the top spot and the US in No. 2.[4]

The city-state presents an attractive living environment for the well-heeled. The leafy, equatorial city is safe, clean, well-run, and boasts excellent schools and healthcare. And in contrast to the worsening political polarization spreading in many countries, Singapore stands out for its stability.

Oasis of calm

Of the 29 countries covered in a recent Ipsos poll on key social and political issues, Singapore came out on top, with 79% of citizens stating they believed their country is heading in the right direction, compared with a global average of only 38%.[5]

In May 2024, Singapore’s former Prime Minister Lee Hsien Loong passed the baton to his party’s chosen successor, Lawrence Wong, in an orderly transition that throws into sharp relief the sense of trepidation around other major elections later this year, most notably the contest in the US.[6]

According to consultancy EY, geopolitics has displaced inflation in 2024 as the No. 1 issue affecting the investment decisions of family offices.[7] This is also expected to drive more wealthy families to relocate their investment office operations to destinations like Singapore.

This shift is happening against the backdrop of a momentous transfer of inter-generational wealth, which has spurred a rise of single-family offices across the globe.[8] As Asia’s richest families prepare to hand down US$2.5 trillion in wealth by 2030, Singapore family offices look set to feature more prominently in succession plans.[9]

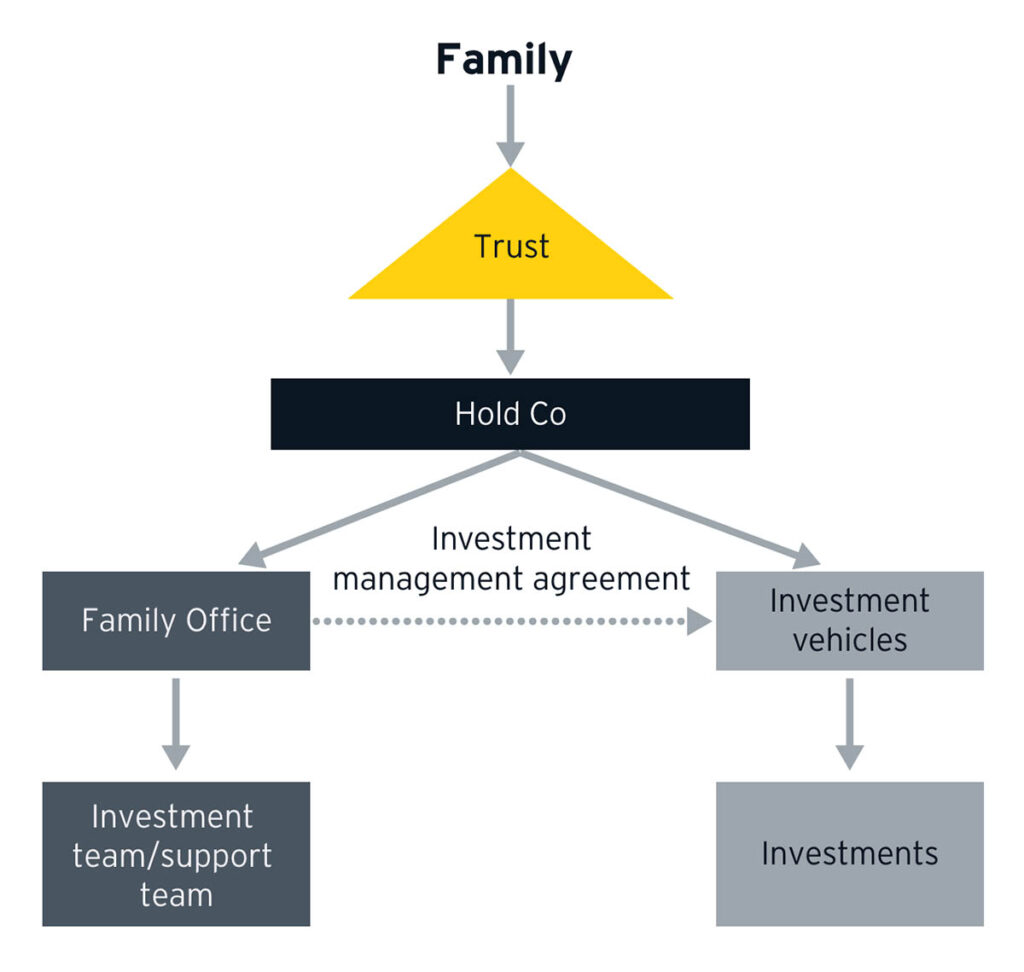

Figure 1: Typical Asian Family Office structure

Image source: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/family-business/ey-the-asian-family-office.pdf

The Korean connection

To this end, many families across Asia are looking to restructure the ownership of their businesses from legacy structures to holding structures domiciled in Singapore using the VCC fund structure, with a case-in-point being South Korea. Increasingly, South Korean family offices are looking to leverage the VCC structure in Singapore to access a wide range of opportunities globally, or around ASEAN, or even back at home. For instance, AIP Investment Partners, part of the Seoul-headquartered AIP group of asset management companies, uses the VCC platform in Singapore to invest alongside family offices in Korean startups in the growth stage.[10]

The rise of South Korean family offices moving to Singapore is a reflection of the increasing focus of the country’s businesses on ASEAN. Ties between South Korea and ASEAN have deepened steadily since they signed a deal for a free trade agreement in 2005.[11]

Today, ASEAN is the most popular destination for Korean travelers, and Korea’s second largest trading partner and investment destination.[12] What’s more, the relationship is set to become even closer as South Korea’s corporates look to ASEAN as a manufacturing base to diversify their supply chains.[13]

Seeking wealth preservation

Recent events at home may also have bolstered Singapore’s appeal to wealthy Koreans. Hopes that South Korea might cut its inheritance tax rates — among the highest in the developed world — were dashed following the country’s legislative election in April 2024.[14] The party of President Yoon Suk Yeol, who had been looking to reduce the levy, suffered a landslide defeat. The newly emboldened opposition bloc in parliament wants the wealthy to pay more taxes.

Heirs of chaebol, Korea’s large family-controlled conglomerates, may be subject to hefty taxes on shares they inherit. After Samsung patriarch Lee Kun-hee’s death in 2020, for example, his heirs had to sell approximately USD2 billion worth of company shares to pay off inheritance taxes due.[15]

The high inheritance tax rate may be one factor prompting more wealthy Koreans to emigrate and move their assets offshore. South Korea lost the world’s seventh-highest number of wealthy people to emigration in 2023.[16]

For the investment community, the planned introduction of a capital-gains tax in 2025 is another cause for concern — in fact, South Korea’s top financial watchdog has warned that if it goes ahead, retail investors might sour on the local stock market.[17]

Singapore, by contrast, has no inheritance tax or capital gains tax on the sale of financial instruments,[18] and low personal and corporate income taxes. And given its political stability, and its generally pro-investment policy stance, this tax regime appears unlikely to face radical changes in the near term. That’s yet one more reason why Singapore’s appeal as a family office hub is likely to grow.

For families with concentrated shareholdings wishing to diversify their portfolios, equities-backed financing from EquitiesFirst provides a convenient, cost-effective means of raising capital to fund investments through any one of the world’s wealth management hubs - including Singapore.

[1] https://citywire.com/asia/news/singapore-s-single-family-office-count-soars-to-1400/a2437714

[2] https://www.iras.gov.sg/media/docs/default-source/e-tax/etaxguides_cit_tax_framework_for_vcc.pdf?sfvrsn=e5af1dc5_20

[3] https://www.simmons-simmons.com/en/publications/ck6q8td091e1l0919ma5e1tgx/singapore-launches-new-fund-vehicle

[4] https://www.henleyglobal.com/newsroom/press-releases/henley-private-wealth-migration-report-2024

[5] https://www.ipsos.com/en/what-worries-world

[6] https://foreignpolicy.com/2024/06/05/singapore-us-uk-government-comparison-elections-citizens-governance-politics/

[7] https://www.ey.com/en_lu/wealth-asset-management/the-future-of-family-offices--a-look-ahead-to-2024

[8] https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/family-business/ey-the-asian-family-office.pdf

[9] https://www.scmp.com/week-asia/people/article/3253023/crazy-rich-asians-next-generation-and-struggle-make-success-succession

[10] https://www.asianinvestor.net/article/family-offices-embrace-singapores-fund-structure-to-manage-money/494840

[11] https://asean.org/wp-content/uploads/images/2015/October/outreach-document/Edited%20AKFTA.pdf

[12] https://overseas.mofa.go.kr/asean-en/wpge/m_2555/contents.do

[13] https://www.scmp.com/economy/global-economy/article/3200860/south-korea-looks-tap-asean-supply-chains-trade-deficit-china-adds-worries-overreliance

[14] https://www.bnnbloomberg.ca/billionaire-families-lose-hope-for-tax-cut-after-korean-vote-1.2060571

[15] https://www.wsj.com/personal-finance/samsungs-lee-family-sells-about-2-billion-in-shares-to-fund-inheritance-tax-c90adead

[16] https://www.koreaherald.com/view.php?ud=20230615000664

[17] https://www.bloomberg.com/news/articles/2024-06-02/south-korea-s-fss-warns-of-outflows-from-local-stocks-on-new-tax?embedded-checkout=true

[18] https://www.iras.gov.sg/taxes/individual-income-tax/basics-of-individual-income-tax/what-is-taxable-what-is-not/gains-from-sale-of-property-shares-and-financial-instruments