25 July 2024

Every technology startup investor should have an exit strategy. One of the most desirable can be an initial public offering (IPO). When a startup goes public, its founders and early investors have the option of either cashing out entirely, or remaining invested as the company uses its IPO proceeds to further grow and expand.

Until recently, the lack of dynamism in the Middle East IPO market was seen as an impediment to the region’s hopes of establishing a vibrant technology ecosystem.[1] Now, even as listing activity elsewhere in the world flounders, the region is witnessing an IPO boom[2] that’s paving the way for IPO exits. This should add further fuel to the expansion of the Middle East’s flourishing technology sector.

Underserved Opportunity

Tech entrepreneurs are being drawn to the sheer size of the opportunity in the region. The growth of the Middle East’s digital economy is expected to outstrip that of the rest of the world by a fair margin in the coming years, according to the TechGPT Compendium published by Swiss investment bank UBS.[3]

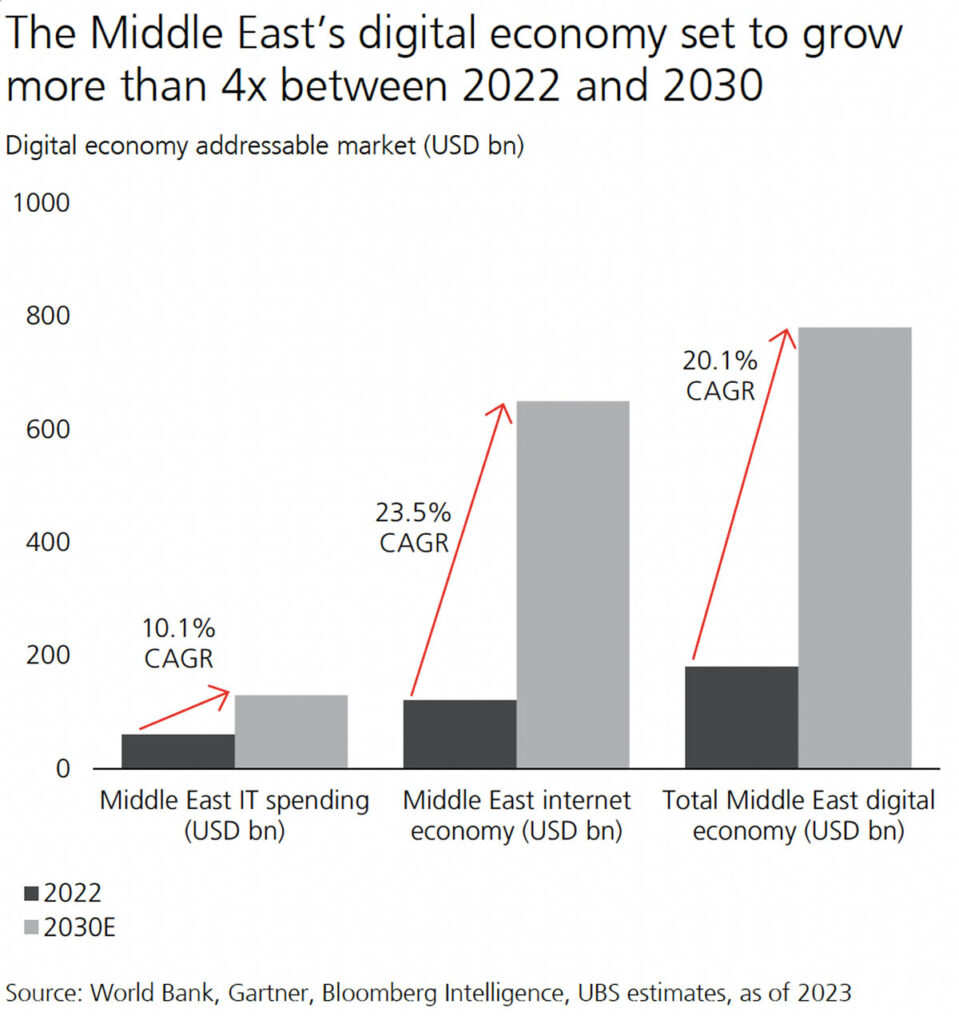

The region’s digital economy is still relatively underpenetrated, worth about USD180 billion, or 4.1% of GDP, compared to penetration rates of 10.5% globally, 15% in the US, and 7.4% in India. But the stage is set for the Middle East to rapidly close that gap. Between now and 2030, its digital economy is tipped by UBS to grow at 20% per annum – double the global rate – reaching $780 billion, or 13.4% of GDP, by the end of the current decade (see Figure 1).[4]

Figure 1:

Image source: https://www.ubs.com/global/en/wealth-management/insights/chief-investment-office/house-view/2023/techgpt-compendium.html

Among the various tech segments, fintech is leading the charge in the Middle East, with several fintech hubs having emerged across the region to support and channel funding to a host of dynamic startups.

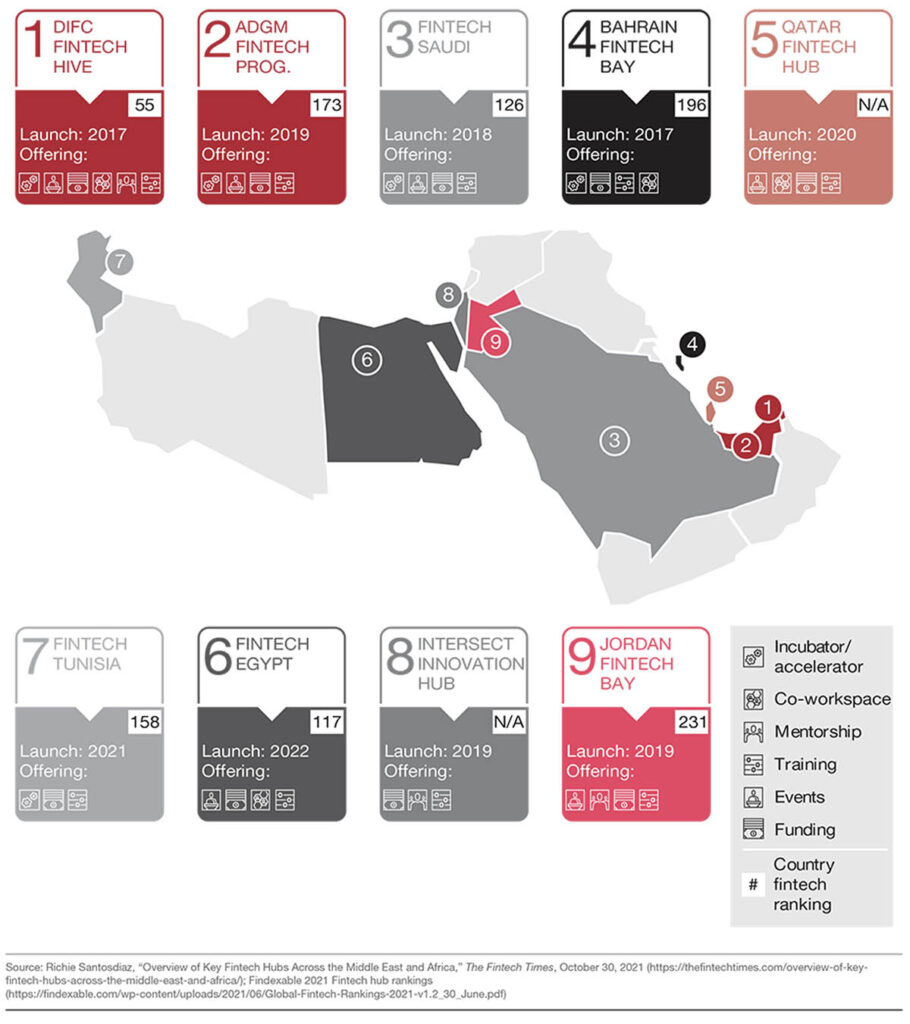

Nine fintech hubs have appeared across the Middle East and North Africa (see Figure 2), led by the FinTech Hive at the Dubai International Financial Centre (DIFC), which opened its doors in 2017. Other globally renowned hubs located in Gulf Cooperation Council (GCC) member nations include the Abu Dhabi Global Market (ADGM); the Bahrain Fintech Bay; the Qatar Fintech Hub; and Fintech Saudi.

Figure 2: Fintech Hubs in the Middle East and North Africa

Fintech attracted $1.4 billion of venture funding in the MENA region in 2023. Since 2021, there have been twice as many deals in fintech as in e-commerce, the second most popular technology segment.[5] The regional fintech segment’s revenues are expected to triple between 2022 and 2025, when they could reach as much as $4.5 billion, according to consultancy McKinsey.[6]

Within fintech, the focus is very much on digital payments, adoption of which was accelerated by the Covid-19 pandemic: in the UAE, for example, non-cash payments rose from 39% in 2018 to 73% in 2023.[7] Government initiatives are also helping, such as Saudi’s Arabia’s Vision 2030 policy, targeting 70% cashless payments by 2025 and the UAE’s efforts to link regional payment systems.[8]

While cash is still king across much of the Middle East, consumer surveys show a strong appetite for digital wallets and contactless payments.[9] Unsurprisingly, payment companies dominate Forbes’ Middle East Fintech 50 list,[10] which ranks the top players revolutionizing the financial technology landscape in the underserved region.

The second biggest category is digital banking, which is also considerably underpenetrated in the region. Only 17% of consumers in the Middle East use digital banking, compared to almost 60% in the US.[11]

Topping Forbes’ Middle East Fintech 50 list is UAE-base Wio Bank, which launched its first digital banking application in 2022. Coming in second is Egypt’s Fawry, a provider of e-payments and digital finance solutions catering to over 52.7 million customers.

For fintechs looking to expand in the region, the UAE is emerging as a preferred base thanks to its supportive regulatory regime, low taxes, well-developed infrastructure, availability of talent (see Figure 2), quality of life, and ability to serve as a gateway to the rest of the region.

Such are the UAE’s attractions that some startup founders boast of being able to lure tech workers from California to relocate there at slightly lower pre-tax salaries.[12] There has been an influx of fintech developers from various parts of the world moving to Dubai and Abu Dhabi,[13] including at cryptocurrency firms attracted by the UAE’s forward-thinking stance on digital assets and tech-savvy local consumer base.[14]

Coming in with a clearer exit

Meanwhile, the IPO frenzy in the Gulf region shows no signs of abating. During 2022/23, Middle Eastern stock markets welcomed 99 IPOs, raising roughly $33 billion combined, according to data from EY.[15]

Although there have been few tech listings so far, that could be set to change following the IPO of Saudi fintech firm Rasan Information Technology in May 2024.[16] Rasan, which provides fintech and insurtech services, started operations in 2017 and serves more than 7.5 million customers in Saudi Arabia.

The IPO boom in Dubai, too, has ample scope to expand.[17] With strong momentum established by privatization of state-related entities and listings by family-owned companies, the next phase of the IPO boom is likely to feature fintechs and other tech firms. By demonstrating lucrative exit options for ambitious entrepreneurs, this could turbocharge the region’s burgeoning startup ecosystem.

Still, with venture investment standing at a five-year low, fintechs and tech entrepreneurs eyeing expansion in the Middle East could find it difficult to access funding in the near term, ahead of global interest rate cuts.[18] Specialty financing could therefore play a vital role in sustaining the Middle East’s fintech momentum and enabling startups to achieve their growth potential in this underserved region.

At this critical juncture in the development of the Middle East’s digital economy, EquitiesFirst has seen strong interest from entrepreneurs seeking to unlock capital from their long-term shareholdings to pursue opportunities across the region.

[1] https://www.strategyand.pwc.com/m1/en/strategic-foresight/sector-strategies/financial-sector-consulting/fintechbuildingmomentum.html

[2] https://www.bloomberg.com/news/articles/2023-12-21/mideast-ipo-boom-to-stretch-into-2024-as-investor-appetite-grows

[3] https://www.ubs.com/global/en/wealth-management/insights/chief-investment-office/house-view/2023/techgpt-compendium.html

[4] https://www.ubs.com/global/en/wealth-management/insights/chief-investment-office/house-view/2023/techgpt-compendium.html

[5] https://www.qedinvestors.com/blog/fintech-in-mena-is-ready-for-its-breakthrough-moment

[6] https://www.mckinsey.com/industries/financial-services/our-insights/fintech-in-menap-a-solid-foundation-for-growth

[7] https://www.imf.org/en/Publications/fandd/issues/2023/09/unleashing-mideast-fintech-amjad-ahmad

[8] https://economymiddleeast.com/news/middle-east-on-cusp-of-digital-payments-revolution/

[9] https://economymiddleeast.com/news/middle-east-on-cusp-of-digital-payments-revolution/

[10] https://www.forbesmiddleeast.com/lists/the-middle-easts-fintech-50/

[11] https://www.imf.org/en/Publications/fandd/issues/2023/09/unleashing-mideast-fintech-amjad-ahmad

[12] https://sifted.eu/articles/dubai-emirates-europe-tech-founders

[13] https://wired.me/business/top-fintech-companies-dubai/

[14] https://cryptoforinnovation.org/the-rise-of-crypto-in-the-uae-a-hub-for-innovation/

[15] https://www.al-monitor.com/originals/2024/03/could-saudi-arabia-spark-tech-startup-ipo-boom-middle-east

[16] https://www.reuters.com/markets/deals/saudi-arabias-rasan-information-technology-prices-ipo-top-range-2024-05-22/

[17] https://prema-consulting.com/dubai-ipo-boom-driven-by-privatization-family-businesses-and-tech-start-ups/

[18] https://www.reuters.com/business/finance/global-venture-capital-investment-near-5-year-low-q1-pitchbook-data-shows-2024-04-03/